We live in a world of monopolies, duopolies, oligopolies, wollopolies, xylopolies – ok, I made that two up – but the increasing concentration and consolidation of corporate power. I say secret because no one really wants it to be made plain. It’s bad for business. But you find them everywhere you look – quite literally.

Are you wearing glasses? Go into your local store and there’s the appearance of choice, right? Oakley? Ray-Ban? DKNY? Sunglass Hut? Prada? Chanel? Ralph Lauren? They’re all made by one company – Luxottica controls 80% of the market.

Or booking a holiday? Where to start? Hotels.com, Trivago, Booking.com, Kayak? Expedia? HomeAway, Priceline? Travelocity? Hotwire? Orbitz? Plenty of choice right. Well, they’re all owned by two companies: Expedia Group and Booking Holdings.

Oil, sugar, banking, tobacco? All concentrated into a handful of corporations. How about the media you consume? If you’re in the US, Comcast controls 70% of the media market. Food? Just four companies control 82% of the beef packing market. The Body Shop? Nescafe? Aero? Felix cat food? And hundreds more brands. All owned by Nestle. Accounting firms since in the 70s have consolidated into four big corporations. Publishing houses, air travel, big tech. Thinking about dying one day? Mergers in 2014 meant two companies now control 82% of the coffin industry.

Everything is getting bigger. We live in an age of the gigantic. The state, bureaucracy, the military, surveillance technologies, big tech, and big business. Things have grown to historic sizes. But the assumption is often that this is automatically bad. The left fears big business, the right fears big government. But if big is automatically bad, then why get big at all? What are the benefits? What are the risks? I think these are some of the important questions of our age. And we don’t really understand it. We don’t often think clearly about what bigness means.

As the historian Charles Geisst has written, ‘the entire period of American capitalism since the Industrial Revolution has been an unrelenting trend toward consolidation.’ And as we’ll see, consolidation, concentration, the authority to control the elephantine growth of modernity, is a story about fascism and totalitarianism too.

A History of the Threat

You cannot understand monopolies without knowing their history. Because the origin of the criticism was not one of corporate power but of royal power. I don’t want to go over this too much again, as I covered it in How Capitalism Conquered the World – only to say that granting an exclusive monopoly on trade was a traditional part of a monarch’s privileges. The monarch would sell, grant, loan the exclusive right to trade in tea for example to one company in the British territories. Thomas Paine described England as ‘cut up into monopolies’ in coal, windows, bricks, iron, tea… the list went on.

As free commerce became more accepted as something that could, in itself, drive growth and innovation, this idea of exclusive monopolies was challenged. This happened at the beginning of the 17th century in England in a famous court battle over whether Queen Elizabeth I could grant a monopoly on the manufacture of playing cards. It was said she was worried about her subjects wasting time gambling, but the most famous lawyer of the period, Sir Edward Coke, said that: ‘The queen could not suppress the making of cards within the realm,’ and that manufacture ‘cannot be suppressed but by Parliament, nor a man restrained from exercising any trade, but by Parliament’.

One member of parliament of the period said, ‘I cannot . . . conceive with my heart the great grievances that the town and country which I serve suffereth by some of these monopolies; it bringeth the general profit into a private hand, and the end of all is beggary and bondage of the subject’.

In the 18th century, the economist Adam Smith – famous for his defence of the free market – warned again the “wretched spirit of monopolies.” He believed that “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

Monopoly had become a byword for unjust authority and control, which combined with the same fear of the oppression of religious beliefs, motivated many to leave England for America. This antimonopoly view was baked into the ideology of the pilgrims, and so many of the first legal codes and constitutions banned them entirely.

The 1641 Massachusetts, the Body of Liberties, a set of laws declared by the colony, said that, “No monopolies shall be granted or allowed amongst us, but of such new Inventions that are profitable to the Countrie, and that for a short time.”

Maryland’s 1776 constitution state that “monopolies are odious, contrary to the spirit of a free government, and the principles of commerce; and ought not to be suffered.” North Carolina’s also said that “monopolies are contrary to the genius of a free state, and ought not to be allowed.”

The aversion to monopolies was one of the causes of the American Revolution. While Britain had granted fewer monopolies since the 17th century, there was still a belief that commerce had to be controlled, especially within the Empire, so that wealth didn’t flow out to competitors like France. The most obvious monopoly was the East India Company’s on tea. Americans had to import British tea only, and the British taxed it, so there was a widespread smuggling economy in lots of products that were taxed. Again, monopoly = unjust authority. And so at the outbreak of the conflict 342 chests of East India Company tea were jettisoned into Boston harbour. Thomas Jefferson went as far as arguing that the constitution should include the freedom of ‘commerce from monopolies.’

Thomas Paine said In Common Sense that ‘there shall be no monopolies of any kind—that all trades shall be free, and every man free to follow any occupation by which he can procure an honest livelihood, and in any place, town and city throughout the nation’.

One America jurist said that ‘Queen Elizabeth lavished monopolies, with a munificent hand [until] All trade and commerce, whether foreign or domestic, was appropriated by monopolists. Industry and the arts languished alike, under these unnatural restraints and fictitious embarrassments.’

Media and tech scholar Tim Wu, who writes a lot about this, writes that ‘the American Revolution in some ways had been foreshadowed by the revolt against Charles I, and that abuse of monopoly by the Crown was one of its great sparks’.

Those early concerns, the values they felt they were protecting, were freedom to choose who to trade with and what line of work to enter, that restraint of commerce was a bad thing for everyone, particularly when backed up by law, and that monarchical authority in retrain of trade was an unjustified abuse of power. But there’s a difference worth pointing out too: that these were monopolies granted by the state, not capitalist enterprises that had grown without the state granting them exclusivity.

Trusts

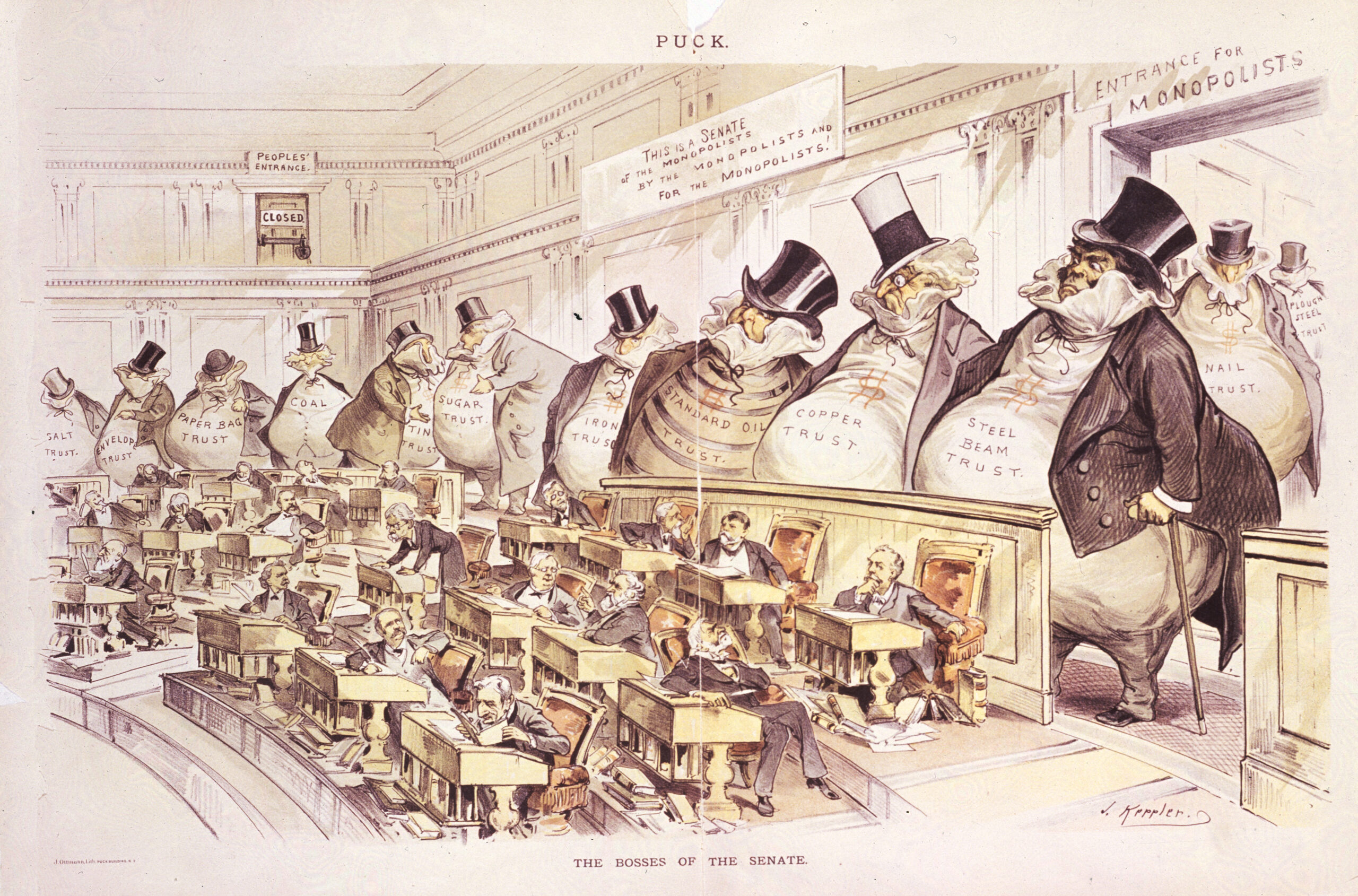

The first corporate monopolies were different. We’ve looked at the history of how these corporations came about in the last video, so I don’t want to revisit that again. It should be enough just to say that by the end of the nineteenth century, as a result of the industrial revolution, giant national conglomerates – or trusts – dominated their industries in oil, meatpacking, railways, coal, tobacco, lead and steel, sugar, piping, biscuits. Led by the robber barons, the more efficient businesses bought out, swallowed up, or outperformed the less efficient competitors.

These capitalist giants were genuinely new in history, and they controlled anywhere between 40% of the market in biscuits, for example, 90% in oil and 98% in sugar. The end of the nineteenth century saw a spate of mergers. One estimates over 2000 companies merging into 157 corporations. This is the meaning of Charles Geisst’s quote – that the history of capitalism has been unrelenting towards consolidation.

The central reason this consolidation happened was that it was, and is, usually cheaper to produce products at scale. Big business went about this in two ways: by consolidating horizontally and vertically. Horizontal means buying companies similar to yours, and integrating them into your manufacturing capacity and supply lines. While vertical integration means buying companies you use or are reliant on.

Take railroads. The American railroad magnate James Hill – who is mentioned in the Great Gatsby – was known as the Empire builder. He bought up land, mines, and even banks to vertically integrate them into his business. All of the great railroad tycoons bought up other railroads. Rockefeller bought up mines for his oil refining empire. Whether it’s sugar or oil, the premise of economies of scale is simple: It’s much more efficient to have one system, unified – growing, shipping, transport, refining, packaging, distribution – than it is to have hundreds separately across the country. So as one business gets bigger, it’s product gets cheaper, making it more profitable for competitors to sell out than it is to continue operating.

So far so good, right? Cheaper products are better for everyone. There were four main issues the early critics of these trusts had. Price fixing, influence, autocracy, and controlling labour. The first – price-fixing – was the observation that while prices may have been cheaper at first, once the competition was wiped out, there was nothing stopping them raising prices. The second critique – influence – was that these Robber Barons had outsized influence through lobbying and bribery to shape legislation and business contracts in their favour. The third criticism – autocracy – was a fear inherited from the earlier critique of monopolies – that like monarchs granting exclusivity, one corporation in any industry looked too much like autocracy. Finally, they aggressively banned or punished unions and blocked workers from leaving jobs to work with competitors.

The first muckrakers, people like Ida Tarbel, who saw first hand what Standard Oil had done to her community with hostile takeovers of smaller businesses, described them as dictators and tyrannists. The Economist used similar language when it described the antics of Fisk and Gould at the Erie headquarters: “They are absolute dictators—neither rendering accounts, permitting discussion, nor regarding any interest but their own”.

It’s really crucial I think to get the criticisms right. So that we can see if they still apply today. To do that, we can look at one of the first populist movements in the world, The Grangers, in the US, who protested that the railroad monopolists were pushing up the costs to farmers when using the railways.

The Grangers

The Grangers were groups of American farmers who organised as a protest against railroad costs in the 1860s and 1870s. They were immediately successful, with a peak of 700,000 members into 21,000 of what they called lodges across the country. Because there was only one railroad company serving hundreds or thousands of farms in an area, the railroads could push up the prices they charged, or use discriminatory pricing to get their way.

AT one meeting someone said ‘In 1860 it cost nineteen cents to carry a bushel of wheat from Chicago to New York. In 1873 it costs thirty-seven cents—nearly double! Why? There are now more railroads to carry the produce and more produce to be carried than in 1860. The reason is there is more robbery!’ Another argued that grain purchasers and railroad companies colluded, saying “There is little or no competition between rival buyers,” he said, “because they either agree each morning to pay a certain fixed price that day, or else agree not to outbid each other, and divide their profits in proportion to the amount each man has bought.”’ One politician pointed to how the ‘“The beef trust fixes arbitrarily the daily price of cattle, from which there is no appeal, for there is no other market.” Another said that the sugar trusts were created “for the purpose of controlling or curtailing the production or supply” so that they could “increase their price to the people of the country.” So, when there’s one or two corporations servicing an entire industry who have no choice but to use your service, there is an incentive to nudge the prices up as much as possible, and theirs no countervailing force in price-signals from competitors. This is the price-fixing critique.

But this wasn’t the only complaint. Outright bribery was common too. Cornelius Vanderbilt’s son – the Vanderbilts were the first national railroad magnates, said “When I want to buy up any politician, I always find the anti-monopolists the most purchasable—they don’t come so high.’

In building Standard Oil, Rockefeller aggressively lobbied, funded and bribed senators. Railroad man Jay Gould bribed government officials, including Ulysses S Grant’s brother-in-law to help manipulate gold markets.

They would often threaten competitors and bribe them in return for not competing. Two steamship lines admitted in hearings that they paid Vanderbilt half a million dollars per year in return for not competing with them.

So there are two types of bribery or lobbying – one aimed at politicians, the other aimed at competitors.

Finally, there was controlling labour. Unions were often banned. But there was also the problem of monopsony. If monopoly means there is only one seller, monopsony is when there is only one buyer, in this case one – or even just a handful – buyers of labour – in other words, employer. The fewer businesses in control of a market the more they can push down wages. Things like noncompete agreements, naked threats, collusion with other business owners to punish ‘troublemakers’ or whistleblowers, can be used to control workers.

The Minnesota Iron Company in 1884 for example had a policy that read: “No person belonging to any combination or union to control wages or regulate time or manner of service will be employed; and any employee entering such combination or union, or endeavoring to control wages…will be discharged promptly and finally, and will forfeit all money earned by him at the time of such discharge.”’

So autocracy, price fixing, bribery, lobbying, controlling workers, banning unions were seen to be common practices. Some of this was tolerated by the American public and politicians if the benefits were clear, but several crashes towards the end of the century convinced Americans to do something about it. Some have called the last few decades of the nineteenth century the long depression. Two of the biggest railroad companies failed in 1873 leading to a national market crash. There were others in 1896 and 1907. The failure of Jay Cooke’s railroad, Geisst says, caused 1873, ‘another in the long history of financial downturns precipitated by the robber barons and financiers.’ Economic inequality was perceived to be getting out of control.

The Sherman Antitrust Act

The Grangers and the Farmers movements were the first to organise and push for legislation. In 1873, the Farmers’ Anti-Monopoly Convention declared the principles that “All corporations are subject to legislative control; that such legislative control should be an express abrogation of the theory of the inalienable nature of chartered rights (meaning essentially that corporations shouldn’t have rights in the same inalienable way people do) and that it should be at all times so used as to prevent moneyed corporations from becoming engines of oppression.”

Iowa was the first state in the world to pass antitrust laws in 1888, making it illegal to “to regulate or fix the price of oil, lumber, coal, grain, flour, provision, or any other commodity or article whatever” or to “fix or limit the amount or quantity” of goods.

Senator John Sherman had been a lawyer and was the main author of the federal bill that passed two years later in 1890. Sherman was a great articulator of the reasoning for passing antitrust legislation.

He said that no social problem “is more threatening than the inequality of condition, of wealth, and opportunity that has grown within a single generation out of the concentration of capital into vast combinations to control production and trade and to break down competition.”

He said in another speech that legislation shouldn’t be designed to stifle free enterprise, but “to prevent and control combinations made with a view to prevent competition, or for the restraint of trade, or to increase the profits of the producer at the cost of the consumer.”’

The key insight or argument was that breaking up or preventing monopoly power wasn’t the suppression of free enterprise. It was the opposite – the promotion of free enterprise.

Section one of the Sherman Act read: ‘Every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations, is hereby declared to be illegal.’

Section two: ‘Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a misdemeanor’

The vague language raises some obvious and difficult questions. What counts as ‘restraint of trade’, when everything a company does is in an attempt to beat the competition. Restraint, contract, and combination are keywords here poured over and interpreted by lawyers. Every successful contract that makes your company better than the competition could be seen as a restraint on trade, and every acquisition of a competitor, no matter the reason, could be seen as a restraint on trade.

The broad philosophy, the idea, was easier than the details of where the line is, though that is often judicially the case. The philosophy, Sherman said famously, was that “If we will not endure a king as a political power, we should not endure a king over the production, transportation and sale of any of the necessaries of life. If we would not submit to an emperor we should not submit to an autocrat of trade with power to prevent competition and to fix the price of any commodity.”

Demonstrating the cross-party consensus that something needed to be done, the bill passed the house unanimously, which must be a one off for a such a seemingly consequential piece of legislation. It passed the senate 51-1.

But because of those ambiguities, the difficulties of defining it, the imprecise language, the Sherman Act wasn’t acted upon for years. In one case, five years after in passed, in 1895, the Supreme Court rejected the government’s attempt to stop the American Sugar Refining Company buying out four smaller companies, which after it went through gave the company a 98% share in the market.

President McKinley’s administration was a laissez-faire one. Wu writes that the philosophy ‘suggested that economic problems would tend to work themselves out, and hence government intervention would usually do more harm than good.”

The banker J.P. Morgan created the steel trust in this period. McKinley didn’t attempt to block the deal. He did, though, hold a dinner hosting and in honour of Morgan – who was seen as the American government’s banker. It points to a problem we’ll explore more shortly – legislate all you want, what happens when a small number of CEOs and politicians dinner together. How can you protect against that kind of unofficial influence. How can you possibly ever know what Morgan and McKinley, say, promised each other over the dinner table in the White House? So legislation isn’t enough. You need a supreme court, a president, a department of justice, and a political and social culture willing to defend it and enforce it.

When Teddy Roosevelt replaced McKinley in 1901, this began to happen. Over two terms, Roosevelt’s government broke up or blocked more that forty different trusts, including beef and tobacco. The big one was in 1911, when Standard Oil was broken up. Rockefeller’s giant owned 67 smaller businesses including piping, marketing, refining, and transport. Public attention was galvanized by Ida Tarbell’s influential series of articles, turned into a book, The History of the Standard Oil Company, which included copies of exchanges between Rockefeller and smaller producers with Rockefeller writing “If you refuse to sell, it will end in your being crushed.” When it was broken up into several smaller oil companies, prices decreased, and innovation improved.

Like, Sherman, Roosevelt was an articulate defender of the antitrust position. He said that “A resolute and practical effort must be made to correct these evils,” Roosevelt concluded. “It is no limitation upon property rights or freedom of contract to require that when men receive from government the privilege of doing business under corporate form, which frees them from individual responsibility, and enables them to call into their enterprises the capital of the public.” “Great corporations,” Roosevelt added, “exist only because they are created and safeguarded by our institutions; and it is therefore our right and our duty to see that they work in harmony with these institutions.”

Another of the most influential thinkers of this period was the supreme court justice (or assistant) Louis Brandeis who coined the term ‘the curse of bigness’. He saw capitalism working best as he’d seen it in his hometown Louisville, were small businesses competed with other small stores in the community. There were no huge factories or corporations, and business owners and the community came together democratically face-to-face.

In 1911 Brandeis wrote ‘‘we are in a position, after the experience of the last twenty years, to state two things: In the first place, that a corporation may well be too large to be the most efficient instrument of production and distribution, and, in the second place, whether it has exceeded the point of greatest economic efficiency or not, it may be too large to be tolerated among the people who desire to be free.’’

But the difficulty in interpreting the philosophy remained. In 1914, the Clayton Act was passed, which aimed to clarify some of the details and prohibit certain practices. Robber Barons, for example, had used discriminatory pricing to control the market. For example, Rockefeller struck deals that meant that competitors would pay the railroads more for transport. This type of price discrimination was banned. Exclusivity contracts that would lessen competitors were also prohibited, as well as being a director of two or competing corporations. It also outlined some thresholds at which the FTC (Federal Trade Commission) would have to be notified of mergers and acquisitions. The lesson of the Clayton Act and subsequent acts like it is that the philosophy is one thing, but the devil is in the details, and a whole body of antitrust law slowly gets built up around a philosophy.

Oligopotarianism

I think it might be useful at this point to reflect on what we’re doing here. It’s applied history. We’re trying to use the past to illuminate the present. Now, history doesn’t repeat, at least never exactly. So history doesn’t provide perfect lessons. But it does help us orient ourselves, gives us some models of action, shows us how we got to where we are. In many ways, applied history is about reasons, risks, and results. We look at the reasons people did things in the past. We look at the results. And we assess the risks of acting or not acting. We’ll return to this idea, but I think this is one of the reasons for Godwin’s Law – that given enough time, someone inevitably brings up Hitler. Because fascism is a marker for what many see as the biggest risk. Why did it emerge, what were the reasons, the factors, what are the warning signs.

Fascism and totalitarianism were in some ways philosophies of the big. They required ‘strong’ men because our infrastructure, financial institutions, corporations, weapons, steel production, military, the state, surveillance networks – you name it – had, by the twentieth century grown to enormous historic sizes.

The Sherman Act didn’t stop this. Steel is the paradigmatic example. Demand obviously continued growing, in building, skyscrapers got talker, railways, bridges, weapons, stronger war machines, household appliances. In the twentieth century all of this really took off. And as demand grew it got cheaper to manufacture steel per tonne at scale in a unified network.

This is why a person as true blooded capitalist American as the banker J.P. Morgan, along with many others, came to believe in the virtue of some kind of centralised planning. He thought competition was ruinous. Here is one of the contradictions of modernity. People become freer to pursue their business interests. Things get bigger. We produce more. Business consolidates and concentrates. And we end up having bigger enterprises and fewer in charge of them. What happens politically when rather than thousands of business owners, spread across a geographical area, there are a handful in capital cities. You get a small class of business owners and politicians, who all know each other, with similar interests, thinking in the same way – you get an oligarchy.

This was increasingly the case in the early twentieth century – in the US, business leaders dined at the White House. In Russia, the entire economy was in the control of a few in Moscow. And in trying to catch up with Britain and America, Germany and Japan both took more top down approaches to the advancing their economies. In Germany, giant cartels like Siemens and IG Farben dominated in steel, armaments, chemicals, and electrics.

These were known as the German ‘rationalizations’, and intellectuals in Germany often saw them as more civilized than the individualistic approach in America because they were rational, controlled, ordered, directed from the centre, rather than chaotic, competitive, scrappy.

One German economist of the period, Gustav Schmoller, wrote that the rationalizations ‘represented a progressive stage in the order of national economy, progress which would inevitably lead to a more highly organized form of the national economy.’

Then, in the 1930s, the Great Depression hit. There is a broad consensus among economists that the highly concentrated German economy made the depression worse. By their large nature, the cartels were rigid and unable to respond by adjusting production levels, experimenting and innovating, or adjusting prices. Even more consequential for German history, the highly concentrated economy made it easier for Hitler to consolidate power himself. He also believed a strong economy required a strong central command – a so-called ‘capitalist planned economy’.

As one German historian writes ‘Germany’s cartels and monopolies proved ‘agile and dangerous pacemakers for the transformation of a free market into an authoritarian market’.

Instead of being spread out, with different views and values, different incentives, different checks and balances, living in different regions, the Nazi leadership and the Cartel leadership were condensed into a tight oligopoly.

As Wu writes ‘And so, as the Nazi Party tottered in 1932, the industrialists, previously divided and moderate, offered major financial support to the Nazis in their hour of greatest need. This was manifested by the ‘circle of friends’ becoming the main financial backers of the Nazi Party.’

In fact, the chemical giant IG Farben contributed 4.5 million Reichsmarks to the Nazis, and profited from labour at Auschwitz producing rubber, and even operated a concentration camp of its own, most infamously manufacturing the gas used in the Holocaust.

US Senator Harley Kilgore summarized matters in 1944: Germany ‘built up a great series of industrial monopolies in steel, rubber, coal and other materials. The monopolies soon got control of Germany, brought Hitler to power and forced virtually the whole world into war.’

The story was similar in Japan. What were called the ‘Zaibatsu’ were essentially national cartels were run by powerful families with longstanding dynastic heritage. The zaibatsu dominated Japanese economy life, controlling businesses and banking, and even sponsoring their own political parties Unlike the West, Japan had a less of a line between business and politics, public and private.

In an influential study after the war, the economic Corwin Edwards published a study concluding that the Zaibatsu were among the ‘groups principally responsible for the war and. . . a principal factor in the Japanese war potential.’

Like Brandies, who believed that the size of government and the size of business were equally threatening, in Germany a group called the Ordoliberals made similar warnings as the Nazis were coming to power.

In 1947, a leading Ordoliberal, Franz Bohm, write: ‘‘Power concentration within the private market will always create potential for war. It matters not whether the command system is National Socialist, socialist or communist in character: what is decisive is the fact that each command system owns an extraordinarily extensive power apparatus which can be centrally deployed and mastered by a very small number of people, that individual positions of power are necessarily apportioned within oligopolistic procedures that can neither be overseen nor vetoed by the public. . .’’

So In the aftermath of WWII, the Allies broke up German corporations and the Japanese zaibatsu. Forty-two Japanese companies were dissolved entirely, and twenty-six broken up.

In the 1950s, the lesson of the war was well remembered. One senator – Estes Kefauver – speaking in 1950 that he said: ‘I think we must decide very quickly what sort of country we want to live in. . . I am not an alarmist, but the history of what has taken place in other nations where mergers and concentrations have placed economic control in the hands of a very few people is too clear to pass over easily.’

Conservatives were fearful as much as liberals. Conservative economist George Stigler, for example, wrote in 1952: ‘The dissolution of big businesses is necessary to increase the support for a private, competitive enterprise economy, and to reverse the drift toward government control.’

I think Kefauver puts it well. The point of fascism as analogy is not to be alarmist, it’s not to go around calling things we don’t like fascist, but simply use history as a guide as to what could happen, why it happened, to construct as thorough narrative about where we are and where we’ve been as we can.

Technomonopoly

The comparisons with Japan and Germany get even more interesting in the post-war period. Picture the world economy and the advances of the period. West Germany and the West more broadly continued growing quicker the more centrally commanded East Germany and USSR. But a more insightful analogy appears when you compare tech in the US with tech in Japan.

AT&T – the American telecommunications giant – was the biggest company in the world, employed over a million staff, and was created by none other than JP Morgan. Importantly it controlled telephone services, telegraphy, plus the hardware, the installation, most of the phones and equipment, plus it was very close to the US government and military, working on nuclear warning systems and missiles. In other words, it was the at the forefront of innovation and technology.

In computing, IBM had a similar monopoly. In those days you would be buy a computer packaged with both IBM hardware and software, just as AT&T sold you line rental and phone hardware. It was all done by one company.

Across the Pacific, with a newly decentralised economy, Japan was surprising everyone by quickly catching up, with companies like Sony, Fujitsu, Sega, Nintendo. Many in the US saw not Europe, not Canada, not the USSR, but Japan as the biggest competitor.

This is where it gets contradictorily interesting. What’s the intuitive thing to do in this scenario? You have the best tech companies in the world. More successful than any company in history. Surely the intuitive thing to do is to support your innovators, your business leaders, the ones bringing profit into the country, make sure they have what they need, give them more power. The US did exactly the opposite. Drawing on that antimonopoly magna carta, cases were brought against IBM throughout the period and then broke AT&T up into smaller companies in the 80s.

Wu says ‘According to the logic of national championship, the American move was irrational, stupid, even suicidal.’

During the IBM trial the company spent up to a billion dollars on their defence. It lasted for years. One legal journalist wrote in 1982 that ‘‘a farce of such mind boggling proportions that any lawyer who now tries to find out about it. . . will be risking the same quicksand that devoured the lawyers involved in the case’’.

At the same time, Japan did the opposite. It wanted to be the first country to build a giant supercomputer. So what better thing to do than support your big innovative leading companies to do so. Why wouldn’t you? Walkman? Space invaders? Pacman? Sony? So in the 80s, that’s what they did.

But there was one thing that no-one really saw coming. It wasn’t supercomputers that were going to change the world, but smaller personal computers. Innovation wasn’t coming from those big institutional slow-moving mono-thinking giants, but from scrappy start-ups like Microsoft and Apple in garages in Silicon Valley.

What happened next? The US had another tech revolution, while Japan fell behind. Compared with Silicon Valley, no new Japanese tech firms came out of the 90s/00s. Counterintuitively, not supporting the giant dominant seemingly technologically advanced players, is the way to get innovation coming from outside. The big players are focused on what they do. The same happened with Microsoft after grew into the giant it is today. Bill Gates didn’t believe in the internet at first. Innovation came from outside the company – in AOL and Netscape.

AT&T could have dominated the internet industry, as it had a monopoly on long distance wires, hardware, everything to connect. It even tried to crush rivals like MCI who were trying to innovate with microwave long-distance services. Phone rates fell by 40% when AT&T was broken up.

Learning From the Past

Which gets us to today. In particular, the focus on big tech and those conglomerates at the beginning. The point of applying history is to do two things: remember that history doesn’t repeat, so there are no immutable repeatable 1:1 lessons, while simultaneously thinking about how the past is one of the only references point we have. We should use then it as analogy. What might happen? What were the results when it happened before? What are the risks of not acting? What’s the same and what’s changed? It’s useful to have a loose list of concepts, and how they relate to each other, in mind to then apply to present problems.

Let’s think about a few.

Risk One: Exclusionary Practices

This is the big one. Price-fixing, conspiracy, cartels, attempts to monopolise, certain non-compete agreements; in the US, the FTC looks on all of these as exclusionary, as rigging the market. The big fear here is the artificial inflation of prices. The most obvious place this happens is when a company becomes so dominant it can push up prices without the fear of a competitor lowering their own to compete.

Study after study show how prices are pushed up after consolidation. Prices for TVs have gone up more than inflation for every year of the past twenty years. Or take that sunglasses manufacturer, Luxottica. Sunglasses can now be made for a few dollars, and so the margin is often 5000%. One example of how this is sustained: in 2007, Oakley tried to drop their prices to compete with Luxottica. Luxottica responded by taking Oakleys out their stores, which devalued the firm, and them Luxottica bought Oakleys in a very hostile takeover. One study used in court showed that having a Wild Oats store in the vicinity of a Whole Foods caused prices to drop. Then Whole Foods bought out Wild Oats and prices went up.

Risk Two: Corporate Tyranny

Then there’s lobbying, bribing, using market power to skew contracts or regulations. This was the original critique inherited from monarchical monopoly and Sherman’s complaint that: if we won’t accept a King in the political realm we shouldn’t in the economic. The risk here is on an axis between democracy and oligarchy. Do we want to live in a society where concentration moves towards a small group with disproportionate power. The big risk analogy here is Japan and Germany in the 30s but also China today, tightly controlled so-called ‘everything apps’ like WeChat that not only captures all data but has a close relationship with the state known for dystopian surveillance.

As Walter Bennet wrote, ‘nothing provides a finer weapon for the budding dictator than a concentration of economic power which he can take over at the top.’

Risk Three: Wage Depression

Then there’s the effect monopolisation has on work and wages. Union busting, punitive terms and conditions, and the downward pressure on wages are more common when there are fewer companies to sell your labour too. This was the monopsony issue we looked at.

This isn’t just academic. To take one example, In 2006 Nurses sued hospitals in America who has violated antitrust laws by depressing nurses wages by a secret agreement. Apple and Google have been accused of having antipoaching agreements. Noncompete agreements are common.

Risk Four: Discourages Innovation

This is difficult to measure but I think the evidence is strong that innovation tends to come, not always, but tends to come from individuals and smaller companies. When AT&T was broken-up, the phone network and tech didn’t suffer, if anything there was innovation. The same with IBM. This was the comparison with Japanese companies we looked at. Microsoft has a history of buying, copying, or excluding competitors products. After Standard Oil was broken up, because the smaller companies had to compete, there were innovations in things like surveying, drilling, and transport.

Benefits

Finally, we also have to acknowledge the benefits of being big. Theoretically, buying out smaller companies is profitable for both because of economies of scale which should make products cheaper for all of us. Then there are network effects – which apply to both trainlines, for example, and Facebook – that the more people are connected, the bigger the network, the better it is, and the higher the costs of leaving.

Solutions

Finally, we use the past to look at solutions, approaches, plus how they’ve changed. Each new generation approaches this subject in new ways, as technology, industry, politics changes.

The issues with Meta, say, are not the same as the problems of Standard Oil, although there might be some cross-over. There is the issue that as new regulations are passed because of changing conditions the law becomes so overregulated so as to become too generalised. In other words, regulations passed to address issues with Standard Oil might prohibited a tech company from doing something that is warranted because the conditions are different.

In short though, some of the solutions are Stopping mergers (what percentage share?), breaking up (in the last resort), Microsoft consent decree, which instead of breaking Microsoft up, required it to play by certain rules like not forcing competitors to package Internet Explorer with Windows. Then there are specific laws and regulations prohibiting certain practices – price fixing, exclusionary practices, non-compete practices, and so on.

Monopolies Today

The global economic landscape today is in many ways even more concentrated than it was in the 19th century. The biggest question is how concentrated do you allow a market to get? In many industries – from search engines to microprocessors to shopping malls – where over and over, 3-4 companies have 95% plus market share. On the other hand, that doesn’t mean they’re monopolies, if each has a 25% share.

Take something like toilet paper – dominated by a handful of companies. It’s a simple product that benefits a lot from giant economies of scale. As long as there’s some competition between them that stops us paying big bucks per wipe – I feel there’s so many jokes here I’m just gonna move on – then that’s good, right?

So let’s look at the elephant in the room, Big Tech.

There are a number of antitrust suits against Google, Meta, and Apple going through the US courts right now.

A judge recently ruled that Google had violated the Sherman Act and had a monopoly in search. The ruling argued that contracts with Apple and phone manufacturers to make Google search default was ‘exclusionary’, with the Judge saying that ‘“The prospect of losing tens of billions in guaranteed revenue from Google — which presently come at little to no cost to Apple — disincentivizes Apple from launching its own search engine when it otherwise has built the capacity to do so’.

In other words, Google pays apple $20 billion dollars per year to have Google search as default. The Department of Justice argues that Google uses ‘the power of defaults’ to maintain a monopoly anti-competitively. Google ads exec Jerry Dischler also admitted Google hiked up ad prices quietly.

Importantly, under US law, it is not illegal to have a monopoly, only to obtain or maintain one illegally. As Lauren Feiner at the Verge writes, ‘The DOJ [Department of Justice] argued that Google illegally monopolized the general search advertising market by effectively cutting off key distribution channels for rivals through exclusionary contracts.’

And Meta – Facebook’s parent company – has been accused by the FTC of buying Instagram and WhatsApp as “engaged in a systemic strategy” to “eliminate threats to its monopoly.”

Facebook saw the fast-growing Instagram as a direct competitor. When Facebook bought Instagram in 2012 for $1billion it had around 30 million users. Facebook had approaching a billion. But Instagram was growing at a million users per day, and as TechCrunch reported at the time, was on track to surpass Facebook. Regulators in the UK decided it was fine because they weren’t competitors, as Facebook wasn’t a ‘photo taking app’. WhatsApp was similarly purchased for $19 billion.

One of the issues antitrust law has to deal with is market concentration and how it’s measured. There are no hard and fast rules but they use measures like HHI to work this out, and a rule of thumb is that a 50% market share = a highly concentrated market that will likely be scrutinized.

Another issue is how you classify industries. What counts as a social media platform, for example. Do you include Facebook, Instagram, WhatsApp, Reddit, Twitter in the same category. Is WhatsApp fundamentally different, or could it have become a social media platform?

Conclusion

Much of this comes down to calculations of risk, reward, and imperfect solutions. What size do you allow something to get? What counts as exclusionary? What counts as price fixing? How do you measure such a thing as the potential future effects on innovation? What kind of business meeting counts as a ‘conspiracy’?

In a 1963 case, the Supreme Court established an influential precedent that mergers resulting in a 30% market share are unlawful. If you were looking at breaking up Meta into three separate companies – Facebook, Instagram, and WhatsApp – the case could quite easily be made that Meta exceeds that market share, and did so when Facebook bought Instagram in 2012.

And breaking up a company in not the only solution. Sure, you can go to DuckDuckGo instead of Google easily, but the DoJ’s (Department of Justice) case is that Google’s deal with Apple stops Apple from creating their own search engine. If that’s exclusionary then you can prohibit deals like it specifically.

All things considered, the risk of not intervening is high enough, and the potential of rewards also high enough, to warrant the intervention. What’s the downside of breaking up Meta? Even shareholders benefit if the individual companies become more innovative.

But we should also remember that Big Tech is new. The solutions that worked for Standard Oil might not be suitable for social media platforms. With such a new technology, radically new thinking is needed. But that’s for another video.

As Wu writes, ‘it is notable that the peak of anti-monopoly enforcement coincided with a period of extraordinary gains in prosperity in the industrialized world, and also gains in wealth and income equality.’

Those Ordoliberals in Germany compared an ideal government to a gardener, cutting back plants that had become too overpowering to let other plant thrive; weeding, tending to the garden, encouraging new flowers to grow.

Sources

Charles Geisst, Monopolies in America

Amy Klobuchar, Antitrust

Tim Wu, The Curse of Bigness

Eric Hobsbawm, The Age of Revolution, The Age of Capital and The Age of Empire

Levy, Ages of American Capitalism

https://www.theverge.com/2023/9/19/23880275/google-search-ads-competition-auction-prices-doj-trial-antitrust

https://www.theverge.com/23869483/us-v-google-search-antitrust-case-updates/archives/3#stream-entry-8ae890bf-2b55-43fd-b9e4-14dd1886ad7e

https://www.jstor.org/stable/2752281